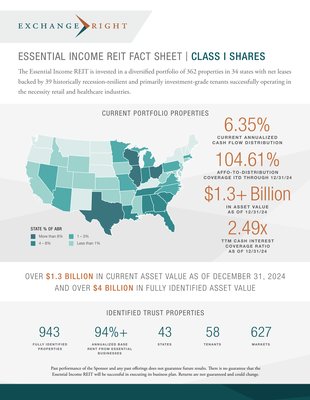

The information contained on this website represents ExchangeRight’s view of the current market environment as of the date appearing in this material only. Past performance does not guarantee future results. Financial information is approximate and as of the date noted.

Important Disclosure Information

There is no guarantee that Essential Income REIT (the “Essential Income REIT” or “Trust” or “Investment”) will be successful or that the Trustee will be successful in executing the Essential Income REIT’s objectives. In the event of a market downturn, there may be lengthened illiquidity and/or disruption in performance.

This Investment relies upon the decisions of the Trustee. Prior successes by any previous investments or their principals, officers, or managers are not indicative of future performance, nor are they any guarantee of liquidity, of a shorter- or longer-term hold period, against loss, or against an interruption or reduction in income—all of which are risks of real estate and real estate investments, including this Investment. The principals of the Trustee have conflicts of interest that could impact the management of this Investment based on the needs and investment opportunities of other companies. This may lead to a conflict of interest between their various roles, including conflicts with the investors regarding decisions related to the Essential Income REIT and acquisition and management of the Essential Income REIT.

Do not invest solely based on distributions that the Essential Income REIT may be currently generating or targeting to generate. Any distributions will depend upon the successful operation of the properties that the Essential Income REIT acquires. Returns are not guaranteed. While this Investment includes a liquidity feature, there can be no assurance that liquidity will be obtained at any point in the future or that a future liquidity event would be profitable.

The Essential Income REIT plans to utilize leverage, which may magnify the impact of any risks, including fluctuations in interest rates, which may significantly affect the returns of this Investment. Material economic disruption globally or especially in the United States could have a material impact on the value of this Investment and could significantly delay or thwart potential liquidity events. Local development may also impact property values, as is the case with all real estate and real estate investments.

Please note that every real estate investment, including this Investment, is speculative, is illiquid, has the potential for complete loss of principal, and carries downside risks due to variables such as potentially declining market values, releasing risk, interest rate risk, refinancing or financing risk, acts of God, and management and/or operational failures.

The photos included are representative of similar corporate-backed stores and may not be the actual locations included in the portfolio. There is no guarantee that all of the identified properties will be acquired.

“Investment-grade” refers to tenants whose long-term corporate debt rating is considered investment grade by Standard & Poor’s, Moody’s, or Fitch. An investment grade rating is a rating that indicates that a corporate bond has a relatively lower risk of default than a corporate bond with a speculative grade.

Potential investors should consult their own tax and legal advisors as ExchangeRight does not provide tax or legal advice and each investor’s tax considerations are different. Any of the data provided herein should not be construed as investment, tax, accounting or legal advice.

Summary of Risk Factors

Our business, financial condition and results of operations are subject to numerous risks and uncertainties. Below is a summary of the principal factors that make an investment in our Common Shares speculative or risky. This summary does not address all of the risks that we face and should be read in conjunction with the full risk factors contained in our Form 10 filed with the Securities and Exchange Commission.

- Our business depends on our tenants successfully operating their businesses and satisfying their obligations to us.

- Illiquidity of real estate investments and restrictions imposed by the Internal Revenue Code could significantly impede our ability to respond to adverse changes in the performance of our properties.

- We are subject to risks associated with the current interest rate environment and increases in interest rates may negatively impact us.

- Our revenues and expenses are not directly correlated, and because a large percentage of our expenses are fixed, we may not be able to lower our cost structure to offset declines in our revenue.

- We may be unable to renew leases, lease vacant space or re-lease space as leases expire on favorable terms or at all.

- We are subject to risks related to tenant concentration, and an adverse development with respect to a large tenant, such as a tenant declaring bankruptcy, could materially and adversely affect us.

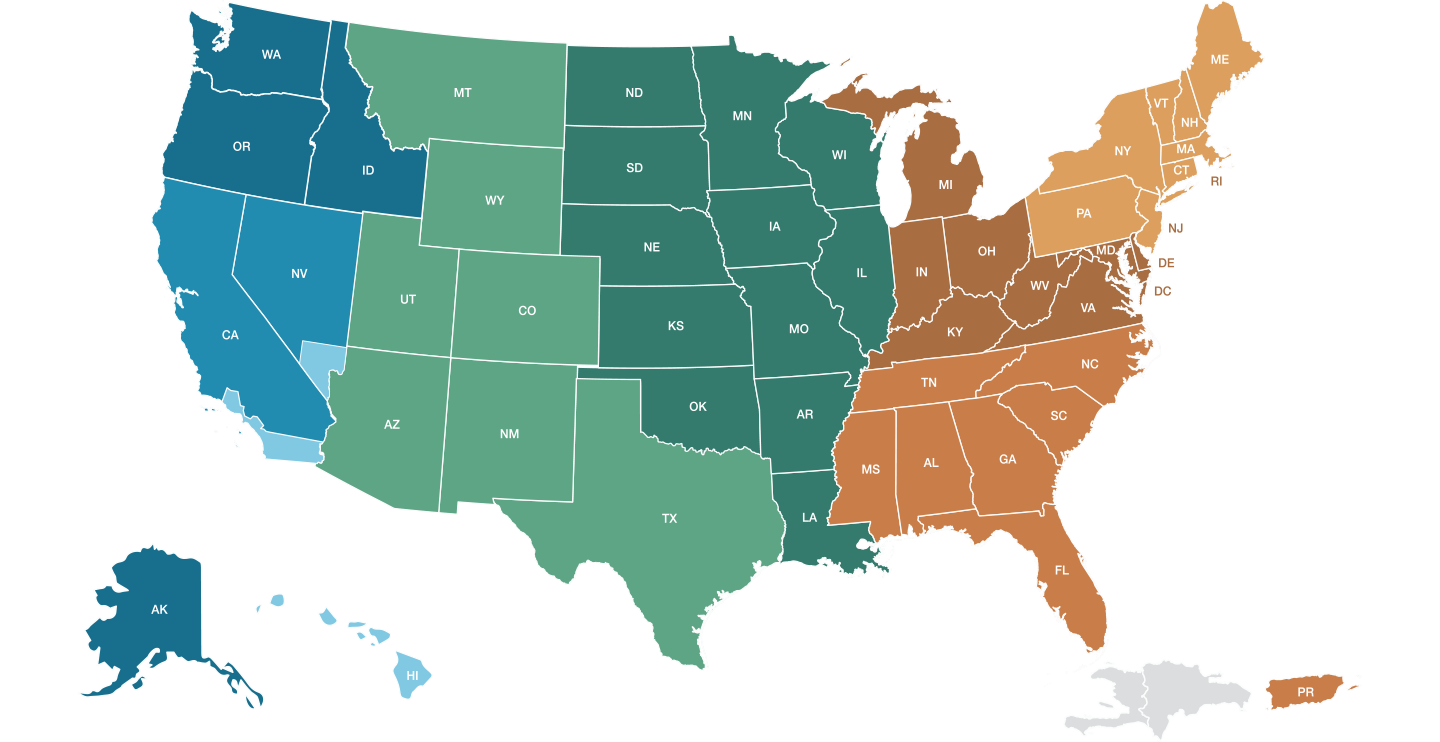

- We may be unable to complete the acquisitions of the newly identified ExchangeRight DST Portfolios or the other identified properties included in the Identified Trust Properties.

- We may not acquire all of the properties that are included among the Identified Trust Properties.

- We may acquire portfolios of properties, which may result in the acquisition of individual properties that do not otherwise meet our investment standards, including properties that are vacant.

- The value of the Identified Trust Properties may fluctuate before we can complete the purchase of any or all of those properties, and we would not likely be able to adjust the purchase price for such acquisition.

- We may only obtain limited warranties when we purchase a property and may only have limited recourse in the event our due diligence did not identify any issues that lower the value of the property.

- We may be unable to identify and complete acquisitions of suitable properties, which may impede our growth, and our future acquisitions may not yield the returns we expect.

- As we continue to acquire properties, we may decrease or fail to increase the diversification of our portfolio.

- Challenging economic conditions could increase vacancy rates.

- As leases expire, we may be unable to renew those leases or re-lease the space on favorable terms or at all.

- REIT distribution requirements limit our ability to retain cash.

- The failure of any bank in which we deposit our funds could reduce the amount of cash we have available to pay distributions and make additional investments.

- Conflicts of interest could arise between the interests of our shareholders and the interests of holders of OP Units, which may impede business decisions that could benefit our shareholders.

- Our growth strategy depends on external sources of capital which may not be available to us on commercially reasonable terms or at all.

- Valuations and appraisals of our real estate are estimates of fair value and may not necessarily correspond to realizable value.

- NAV calculations are not governed by governmental or independent securities, financial or accounting rules or standards.

- In the future, we may choose to acquire properties or portfolios of properties through tax deferred contribution transactions, which could result in shareholder dilution and limit our ability to sell such assets.

- Many of the properties we intend to acquire are currently owned and managed by affiliates of the Trustee.

- Shareholders are bound by the vote of other shareholders on matters on which they are entitled to vote, and shareholders will not have the right to vote on certain mergers, consolidations and conversions of the Company.

- Our Trustee may be removed only under limited circumstances.

- The Company’s rights, and the rights of shareholders, to recover claims against our officers and our Trustee are limited.

- Our Declaration of Trust contains a provision that expressly permits our Trustee, our officers and ExchangeRight, and their affiliates, to compete with us.

- The special limited partner of the Operating Partnership will be entitled to incentive distributions from our Operating Partnership only if the Operating Partnership’s investors have received a return of capital plus 7% cumulative, non-compounded annual return, which may discourage ExchangeRight from facilitating a transaction that would provide liquidity for our common shareholders.

- Bankruptcy of ExchangeRight or any tenant of a property owned by the entity pledged to secure the RSLCA may adversely affect the value of the ExchangeRight Secured Loans.

- The value of our ExchangeRight RSLCA may be impaired, and we may be unable to realize any value upon the foreclosure of the pledges securing the ExchangeRight Secured Loans due to the terms of the underlying mortgage loans.

- The failure of a secured loan to qualify as a real estate asset could adversely affect our ability to qualify as a REIT.

- Our cash flows and operating results could be adversely affected by required payments of debt or related interest and other risks of our debt financing, including an inability to refinance existing indebtedness.

- Financing we utilize may include recourse provisions to the Company.

- High interest rates may make it difficult for us to finance or refinance properties, which could reduce the number of properties we can acquire and the amount of cash distributions we can make to our shareholders.

- Interest-only indebtedness may increase our risk of default and ultimately may reduce our cash available for distribution.

- Our current loans, and loans associated with the Identified Trust Properties which we plan to assume, may be subject to certain unfavorable provisions.

- We would incur significant material adverse tax consequences if we fail to qualify as a REIT.

- Complying with REIT requirements may cause us to forego otherwise attractive opportunities and limit our growth opportunities.

- We may become subject to litigation, which could materially and adversely affect us.

- An investment in our Common Shares will have limited liquidity. There is no public trading market for our Common Shares and there may never be one; therefore, it may be difficult to sell those shares.

Certain information contained in this material has been obtained from sources outside ExchangeRight, which in certain cases has not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of ExchangeRight or any of their affiliates takes any responsibility for, and has not independently verified, any such information.

Opinions expressed reflect the current opinions of ExchangeRight as of the date appearing in the materials only and are based on ExchangeRight’s opinions of the market environment, which is subject to change. Investors, representatives, advisors, and prospective investors should not rely solely upon the information presented when making an investment decision and should review the most recent Private Placement Memorandum (“PPM”), as supplemented, available at

https://www.exchangeright.com/the-essential-income-reit/class-i-shares/. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

All rights to the trademarks and/or logos presented herein belong to their respective owners and ExchangeRight’s use hereof does not imply an affiliation with, or endorsement by, the owners of those logos.

Forward-Looking Statements

Certain statements contained in this website other than historical facts may be considered “forward-looking statements,” and, as such, may involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of ExchangeRight Essential Income REIT to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “may”, “will”, “should”, “estimates”, “projects”, “anticipates”, “believes”, “expects”, “intends”, “future” and words of similar import, or the negative thereof. Forward-looking statements in this registration statement include information about possible or assumed future events, including, among other things, discussion and analysis of our future financial condition, results of operations, our strategic plans and objectives, occupancy, leasing rates and trends, liquidity and ability to meet future obligations, anticipated expenditures of capital and other matters. Readers are cautioned not to place undue reliance on these forward-looking statements.

Any such forward-looking statements are subject to unknown risks, uncertainties and other factors, which in some cases are beyond our control and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations, provide distributions to shareholders and maintain the value of our real estate properties, may be significantly hindered.

This website must be read in conjunction with ExchangeRight Essential Income REIT’s Private Placement Memorandum in order to fully understand all the implications and risks of an investment in the ExchangeRight Essential Income REIT. Please refer to the PPM for more information regarding state suitability standards and consult a financial professional for share class availability and appropriateness.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED IN THE PPM FOR THE OFFERING, AS AMENDED AND SUPPLEMENTED (THE “PPM”). THE OFFERING IS MADE ONLY BY THE PPM AND THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY THE PPM. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY OTHER STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THE PPM IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.